Guidance for Financing Education

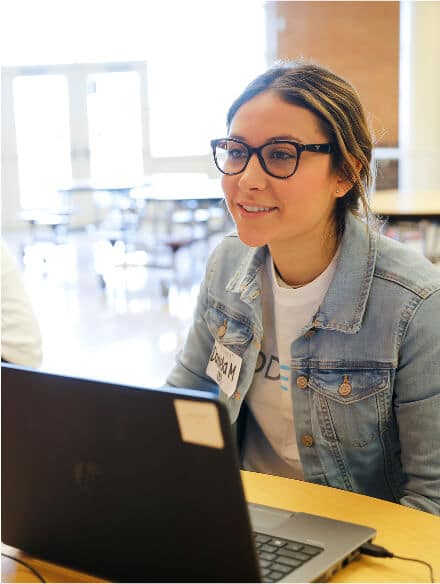

Education can change lives, but rising costs and complex FAFSA forms put it out of reach for many families. We help students and families understand and access financial aid resources to make your dreams possible.

Start your higher education journey

We’ll help you complete and submit the FAFSA so you can access the financial aid you’re eligible for.

Setting high schoolers up for success

We can help you determine a pathway to pay for college. We’ve run 100+ workshops for 1,800 students, helping them navigate college costs, financial aid, and personal statements.

Partner organizations can book large-group workshops

Workshop

College Finances 101

Overwhelmed by student loans? In this workshop, we’ll break down how loans work, what repayment really looks like, and how to borrow smart—so you can make informed choices about your education.

Workshop

Financial Aid Overview (FAFSA)

Financial aid changes every year. In this workshop, we’ll explain the latest updates to the FAFSA and Alternative Application and help you understand what’s new, what’s required, and how to apply with confidence.

Workshop

Complete your financial aid application

Filing for aid can be confusing. In this workshop, we’ll walk students and families through the FAFSA or Alternative Application step by step—making sure everything’s completed accurately and on time.

Planning and financial aid tools

Looking for more support on your path to higher education? Here are some of our top recommended resources to help you plan, prepare, and pay for college:

Federal Student Aid Estimator

Estimate how much financial aid you’ll receive based off of some questions that involve your living situation and family’s income, and your own income. Note: Choose “None of the above” for first question.

Visit site

Student Loan Simulator

The FAFSA Loan Simulator lets you explore different repayment options by showing your monthly payment, total cost, and payoff timeline. You can enter loan amounts manually without logging in or sign in to access your actual loan data.

Visit site

Scholarship Portal

This website lists a wide range of scholarships for different degree programs. Awards vary, and some scholarships may have specific requirements to apply.

Visit site