Am I eligible?

We focus on helping those who need it most, based on income.

But there are some cases we aren’t able to take on. Check if you’re eligible for free services.

We can help if:

Good to know:

If you’re filing a joint return because you’re married, both spouses need to be present.

We cannot help if you:

See full list of exclusions here.

Other tax services

Tax disputes

If you’re in a dispute with the IRS or Illinois Department of Revenue, don’t panic. Our Tax Clinic offers free guidance and legal support to help you resolve any tax issues you have.

Money basics

Learn the essentials to build confidence with your finances. From understanding taxes and FAFSA to basic budgeting and savings.

What documents should I bring when I visit?

ID

Your identification

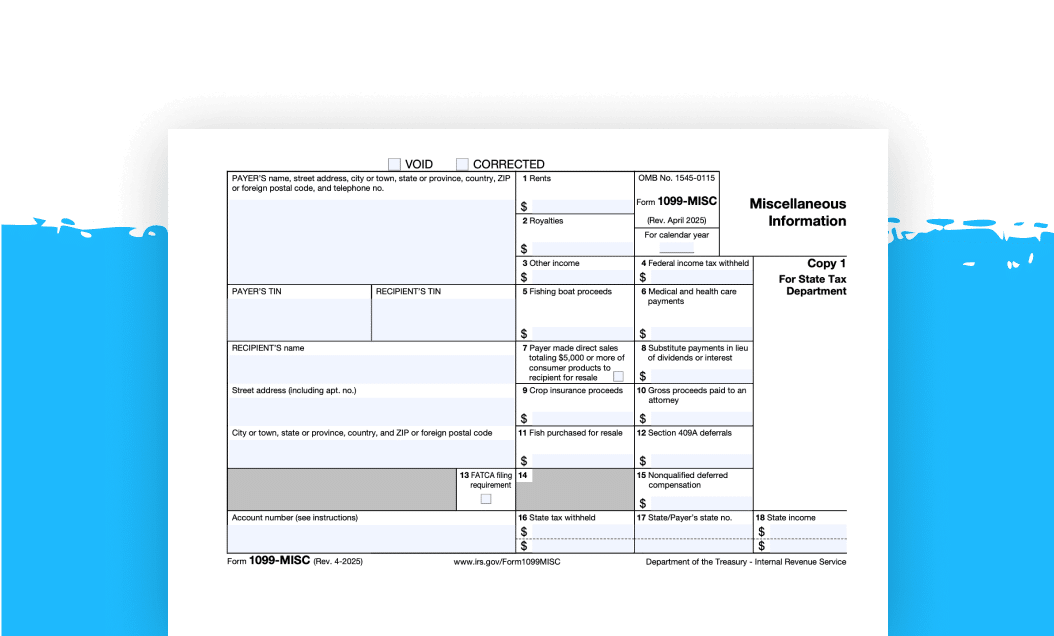

Income

Your income documents

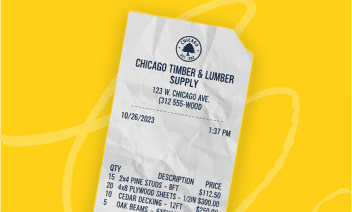

Expenses

Your expense receipts

Find your nearest walk-in location

Find free, walk-in tax support at locations across the State of Illinois, the City of Chicago, Chicagoland area and South Bend, Indiana.

Support for past filings

ID

ITIN support

Need to apply for or renew an Individual Taxpayer Identification Number? We can help.

Email us at [email protected]

or call (312) 409-1555 to get started.

Past returns

Help with past tax returns

If you need to file or amend a prior year tax return, we offer service from June through September.

Refund TRACKING

Where’s my refund?

To check your federal refund, visit: irs.gov/refunds

To check your Illinois state refund, visit: mytax.illinois.gov

Don’t see a result? Reach out to us

and we’ll help check the status of your return.